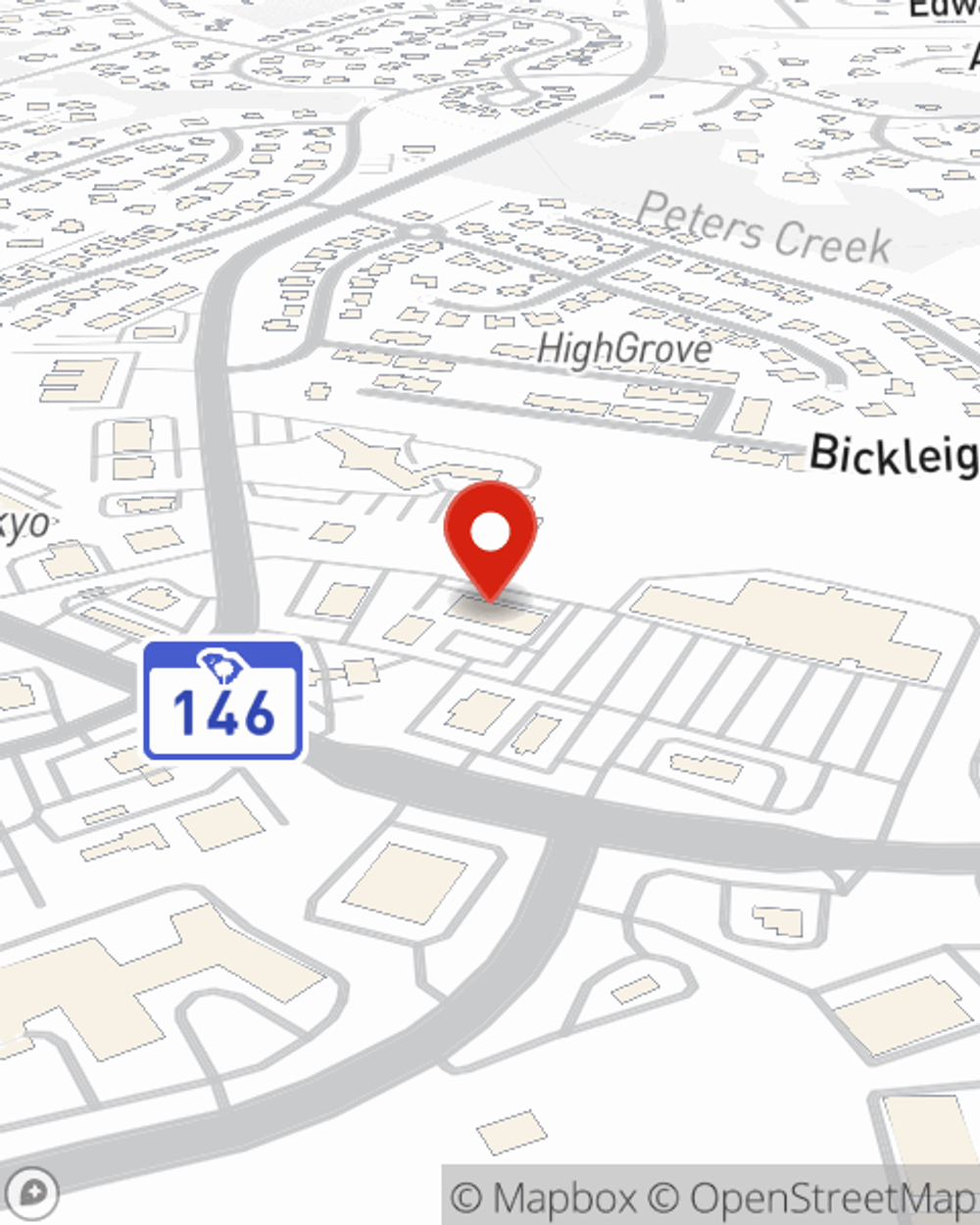

Homeowners Insurance in and around Simpsonville

Looking for homeowners insurance in Simpsonville?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

Investing in homeownership is an exciting time. You need to consider needed repairs home layout and more. But once you find the perfect place to call home, you also need terrific insurance. Finding the right coverage can help your Simpsonville home be a sweet place to be.

Looking for homeowners insurance in Simpsonville?

Apply for homeowners insurance with State Farm

Why Homeowners In Simpsonville Choose State Farm

Agent Tim Gajda has got you, your home, and your keepsakes protected with State Farm's homeowners insurance. You can call or go online today to get a move on building a policy that fits your needs.

More homeowners choose State Farm® as their home insurance company over any other insurer. Simpsonville homeowners, are you ready to see what the State Farm brand can do for you? Visit State Farm Agent Tim Gajda today.

Have More Questions About Homeowners Insurance?

Call Tim at (864) 520-5160 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Surprising household hazards

Surprising household hazards

Some household safety risks may surprise you and knowing a few of the culprits is important to help prevent accidents in your home.

Simple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Surprising household hazards

Surprising household hazards

Some household safety risks may surprise you and knowing a few of the culprits is important to help prevent accidents in your home.